Brokerage account

Invest in stocks with a trusted and award-winning broker

- Access 2100+ shares from the US and Europe

- Avoid unnecessary trading costs – US Shares with 0 EUR commission

(no additional charges on EUR, PLN, CZK accounts)

Account specification

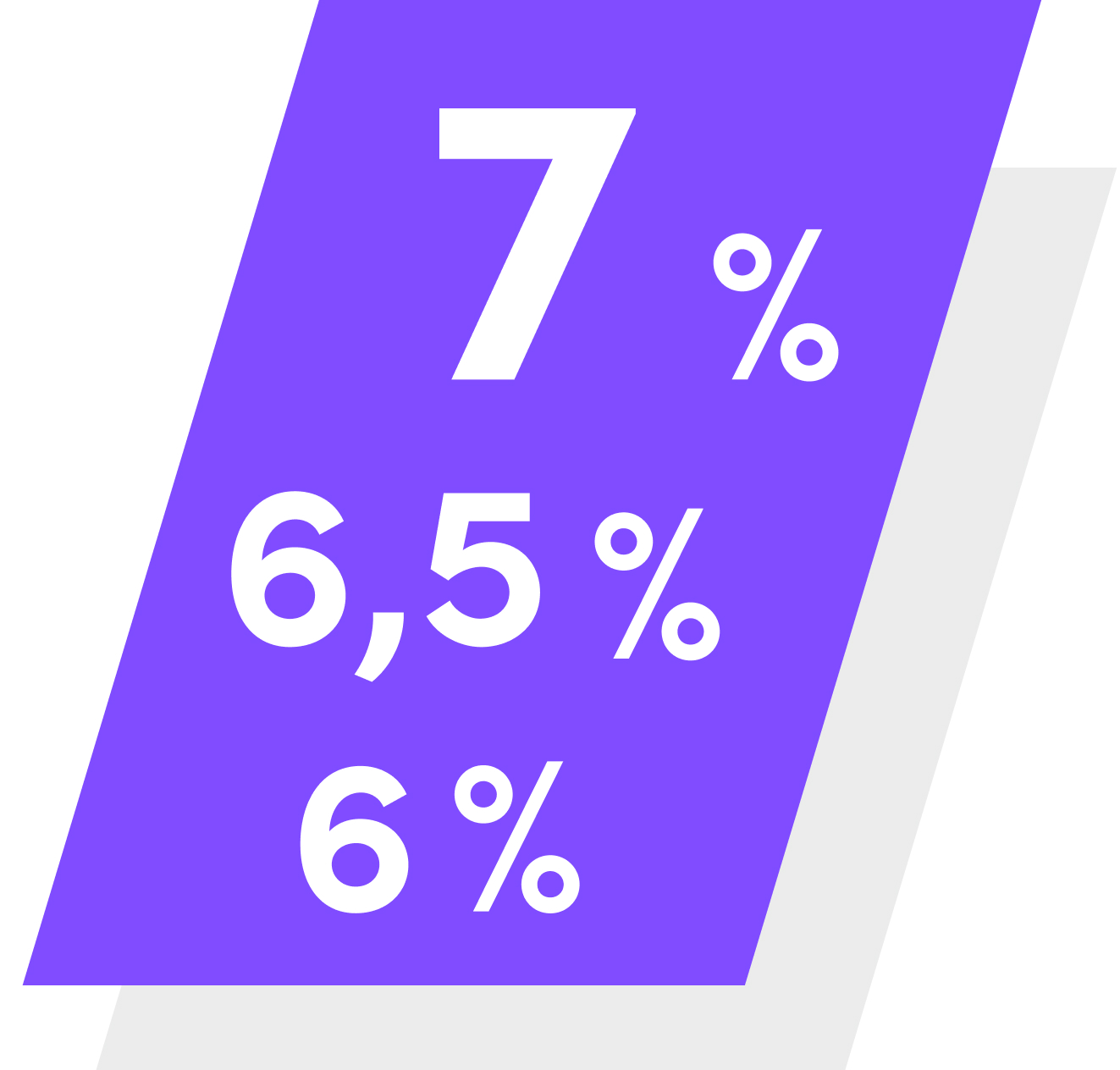

Market | Commission | Min commission |

US | 0% | 0 EUR |

US for accounts in USD | 0,29% | 7 USD |

Germany | 0,15% | 5 EUR |

France | 0,15% | 5 EUR |

Spain | 0,15% | 5 EUR |

UK | 0,15% | 5 EUR |

Poland | 0,19% | 1 EUR |

No fee to open account and managment | ||

No fee to access live market data | ||

Local Language Support | ||

Access to exclusive webinars | ||

Interested in trading in Forex, Indices, Commodities, Crypto,

Shares and ETF's as CFDs? Check out our Retail CFD account

Benefits of your brokerage account

Shares account with access to multiple markets

Open brokerage account and access global markets, thousands of shares at your fingertips from the US, EU and UK. No fee for opening an account with real-time market data.

Avoid unnecessary trading costs

US Shares with 0 EUR commission (no additional charges on EUR, PLN, CZK accounts). No for opening an account and managment.

Day-to-day access to market analysis

With OANDA you gain access to up-to-date market analysis, offering insights into global equity markets, commodities and economic indicators. Read our monthly gold and index market overview, as well as our quarterly reports that delve into market trends and forecasts, and stay informed about the latest developments and potential future scenarios to make better trading decisions.

Over 2100 shares from multiple markets at your fingertips

Interested in trading in Forex, Indices, Commodities, Crypto, Shares and ETF's as CFDs?

Interested in trading in use of financial leverage? Check out differences between Shares and Shares CFDs.

Frequently Asked Questions

- What does a brokerage account consist of?

A brokerage account serves as a platform for trading financial instruments. It acts as a virtual wallet for your investments. Through it, you gain access to real stocks from numerous global markets. The OANDA brokerage account also provides access to a wealth of market information to help you make better investment decisions.

- Are brokerage accounts safe?

Your funds in a brokerage account are well-protected. OANDA is subject to the supervision of the Polish Financial Supervision Authority (KNF). An additional layer of protection is the compensation system, which safeguards investors in the event of a financial institution's insolvency, up to a specified limit. However, it is important to remember that investing in financial markets always carries the risk of losing part or all of your capital. The security of a brokerage account as a financial tool does not eliminate this risk.

- How long does it take to open a brokerage account?

Opening a brokerage account with OANDA is a quick and straightforward process. Registration takes just a few minutes. To open an account, you need to complete an online form, providing basic personal details and the information required for identity verification. Once the registration and verification process is successfully completed, you can start investing.

- How do I transfer money to a brokerage account?

In order to transfer money to your brokerage account at OANDA, you can make a traditional bank transfer or use online payment methods. Log in to the Client Zone, go to the "Fund Account" section, select your preferred payment method, enter the deposit amount, and provide the account number. Follow the instructions of the chosen payment system to complete the transaction.

- Do I pay tax when I withdraw money from a brokerage account?

Withdrawing funds from your brokerage account does not, in itself, trigger a tax liability. However, as an investor, you are responsible for reporting any profits or losses from your trading activities in accordance with local tax regulations. OANDA provides clients with an annual statement detailing the profit or loss achieved in the previous tax year, which can assist in this process.