The US Election and Financial Markets

Explore the intricate relationship between US Presidential elections and their influence on the global financial markets.

How will the 2024 election affect the market?

As the election landscape develops, trade popular forex pairs with OANDA

What impact could a Donald Trump government have on the markets?

This document discusses the potential implications of a Trump presidency on the US economy, focusing on tariffs, the US dollar, and the Federal Reserve, following Trump’s interview with Bloomberg TV on October 15th 2024.

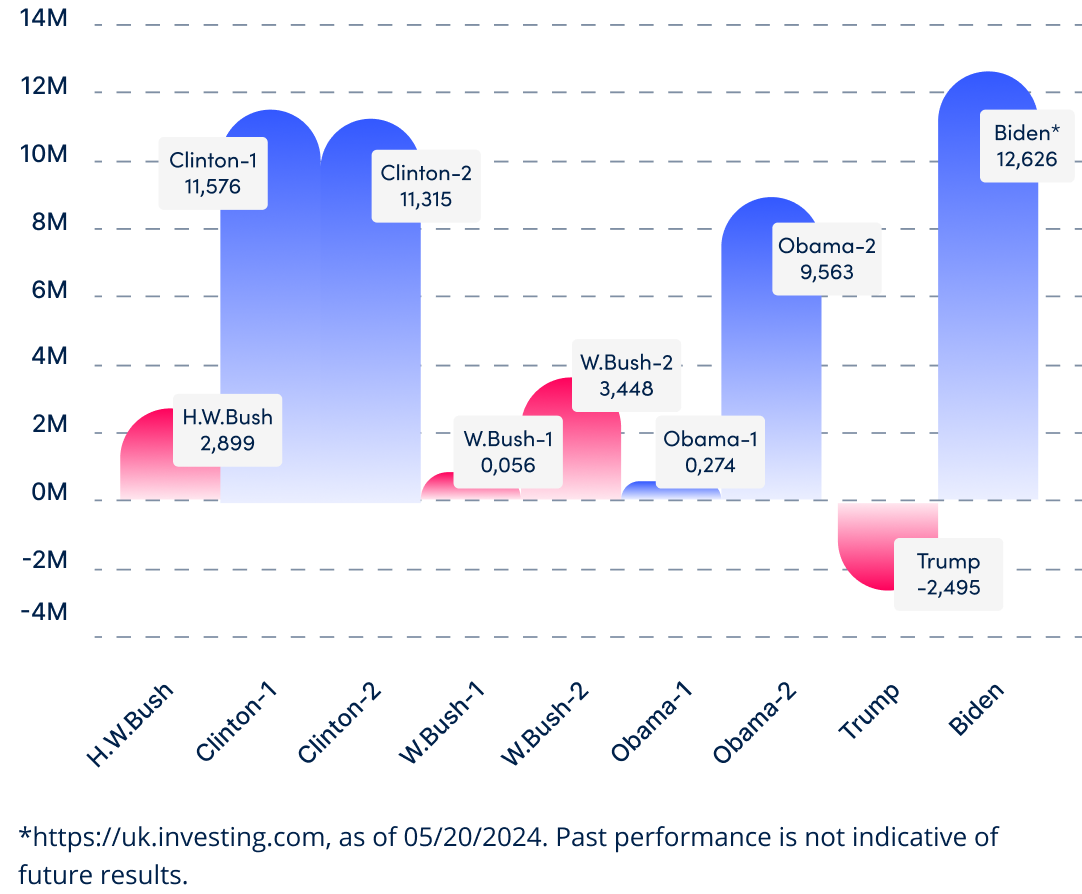

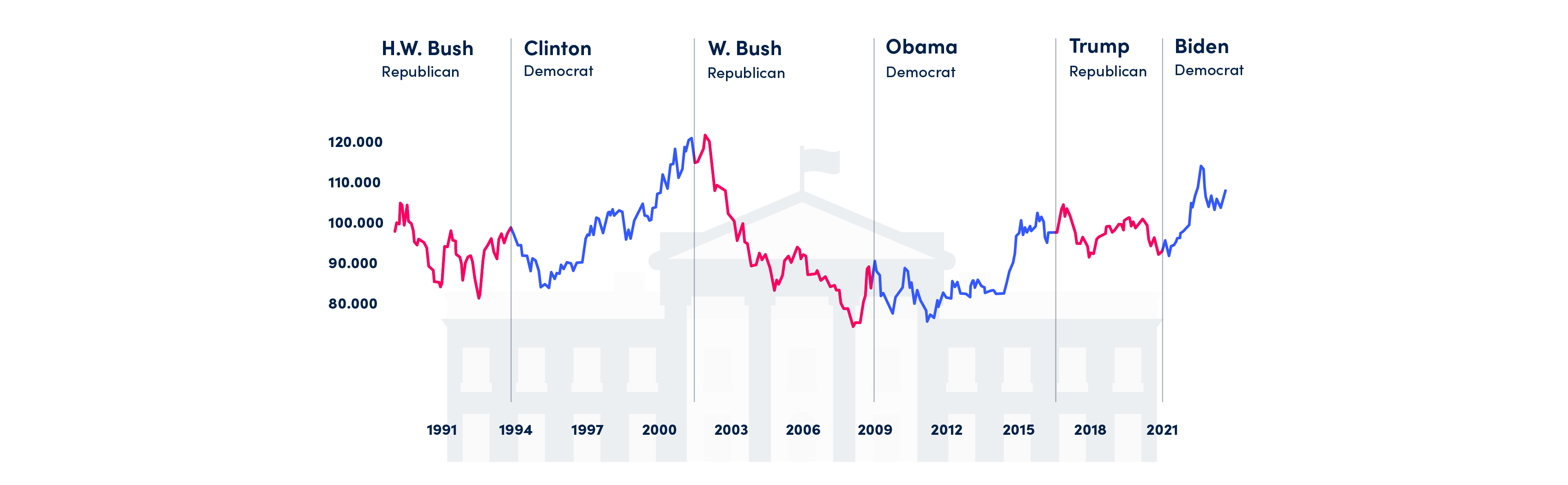

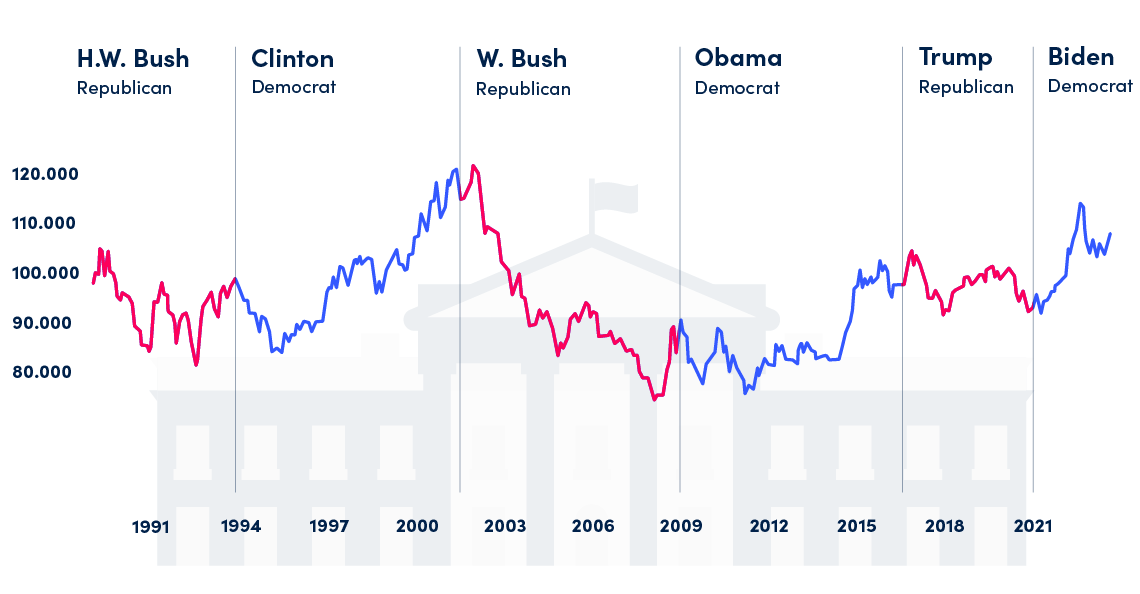

Of the past six administrations, the dollar performed best under President Clinton, gaining 19.61% in value.*

The dollar performed worst under President W. Bush, losing 22.00% in value.*

In aggregate across all Republican terms, the dollar lost -36.17% in value while gaining 54.37% while under Democrat leadership*

*tradingview.com 01/20/1989 - 05/28/2024. Past performance is not indicative of future results.

Following President Biden's announcement to resign from the 2024 presidential race, a level of political uncertainty sweeps the financial markets.

Moheb Hanna, OANDA Senior Market Analyst

Leveraged trading is high risk. Losses can exceed deposits.

*https://democrats.org/where-we-stand/

Our latest coverage

Take a look at our latest market coverage from the presidential race:

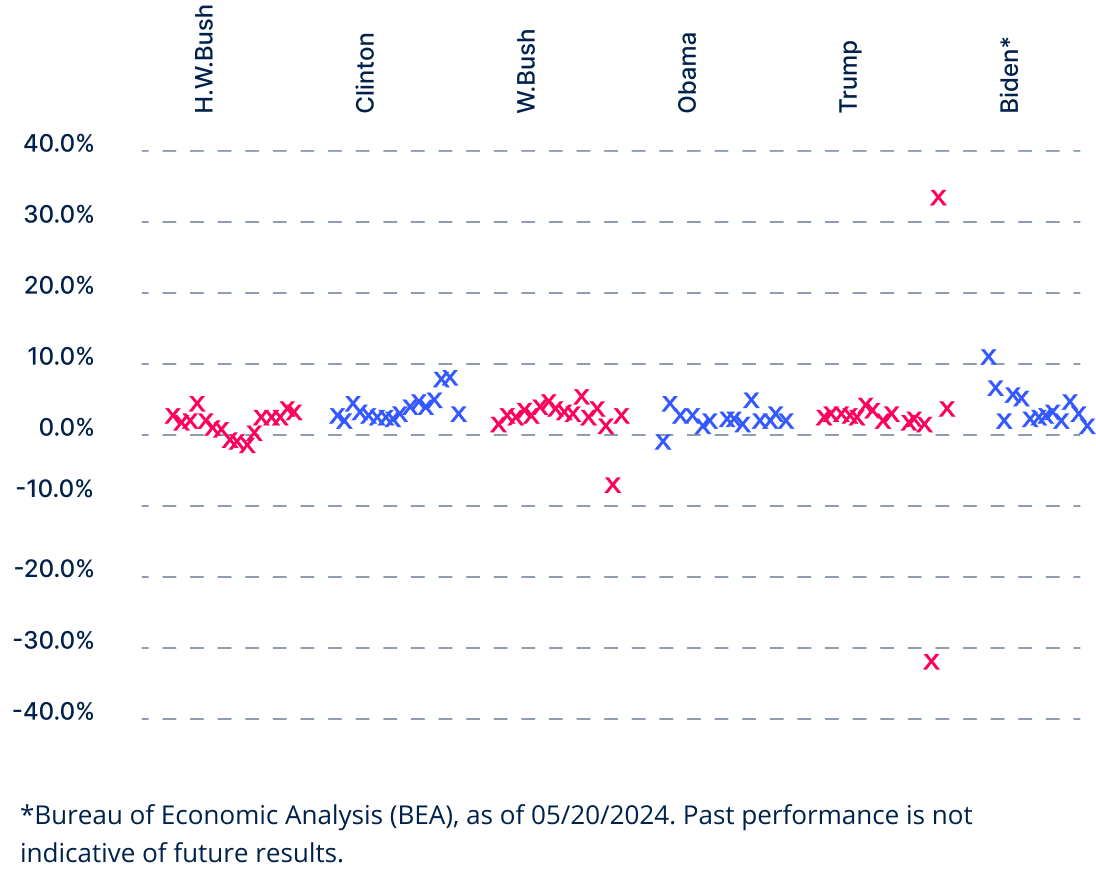

How do previous presidencies compare?

Covering the last six administrations, we collected 976 data points to find out.

TradingView 'Broker of the Year 2023', 'Most Popular Broker' for three consecutive years 2020, 2021, 2022

Invest Cuffs ‘Brokerage House of the Year 2022’

Key economic metrics to follow in the US election

OANDA analyst Moheb Hanna takes you through the key economic metrics that traders should

monitor on the run in to the election.

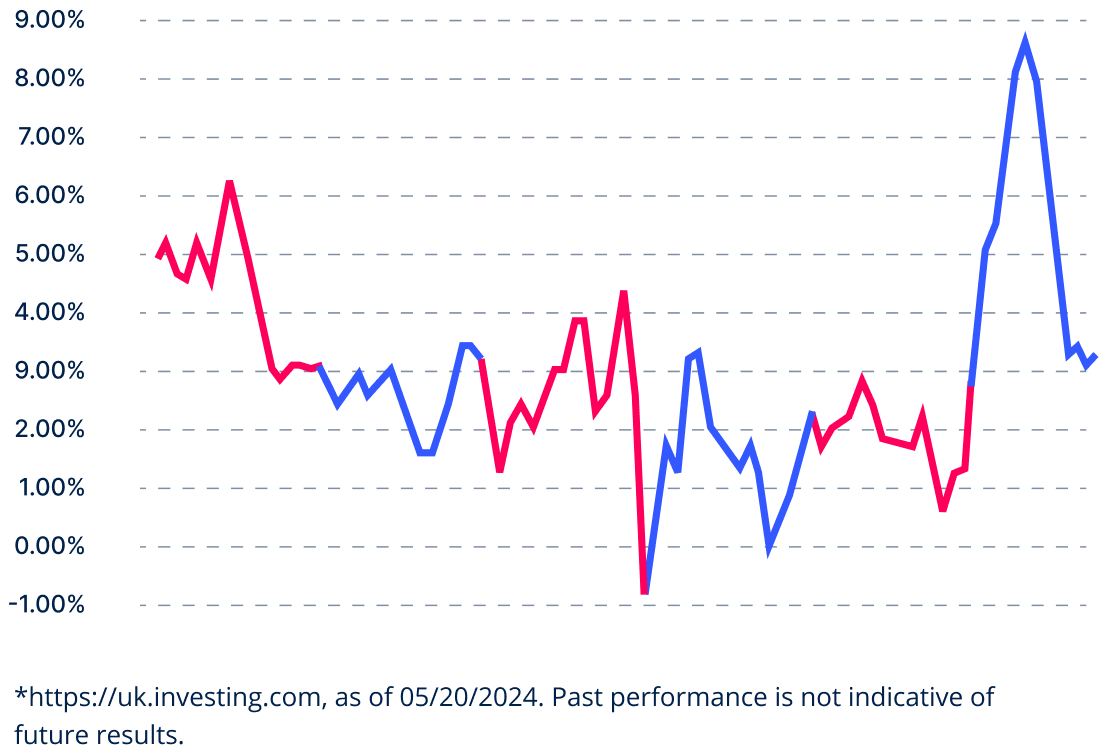

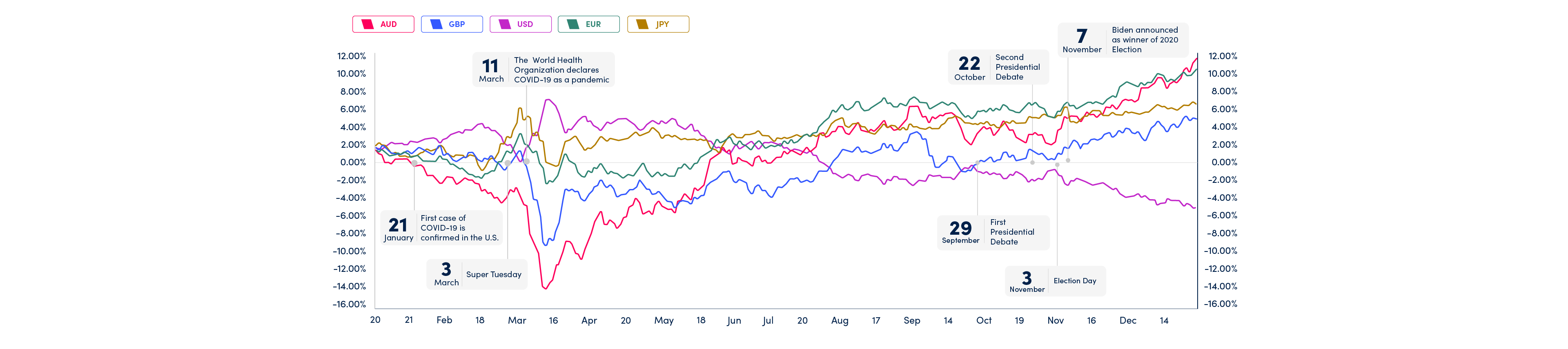

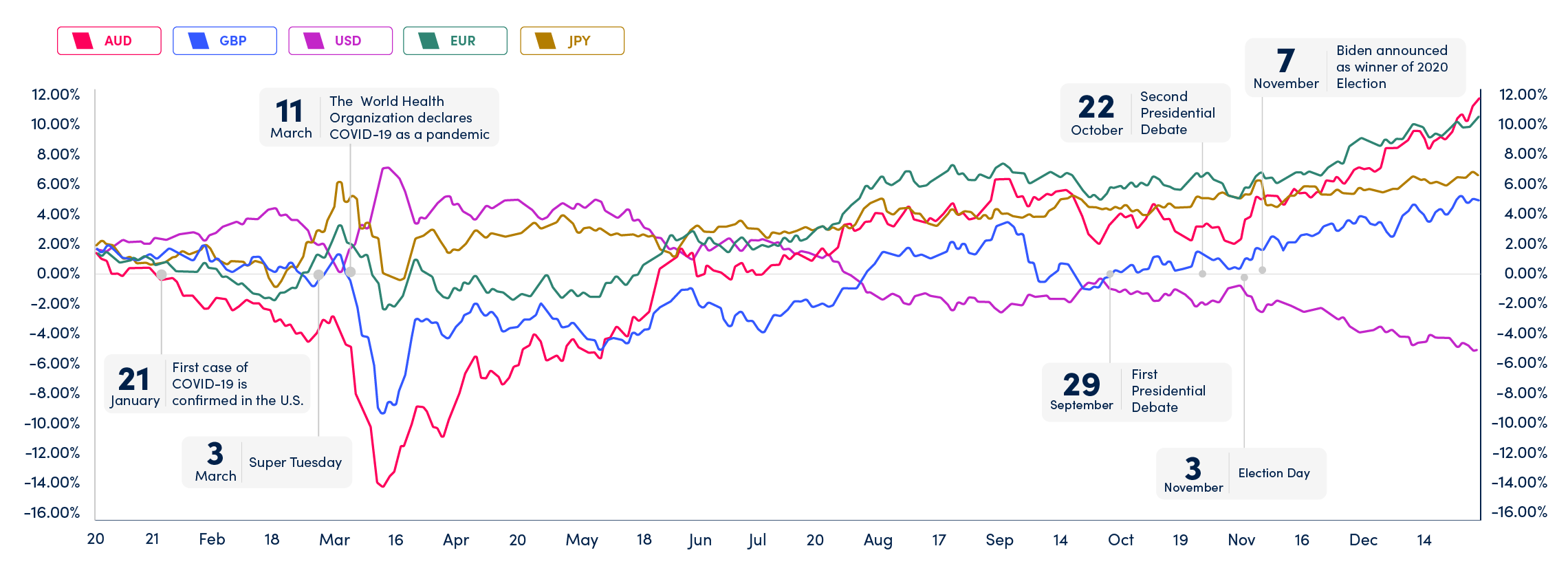

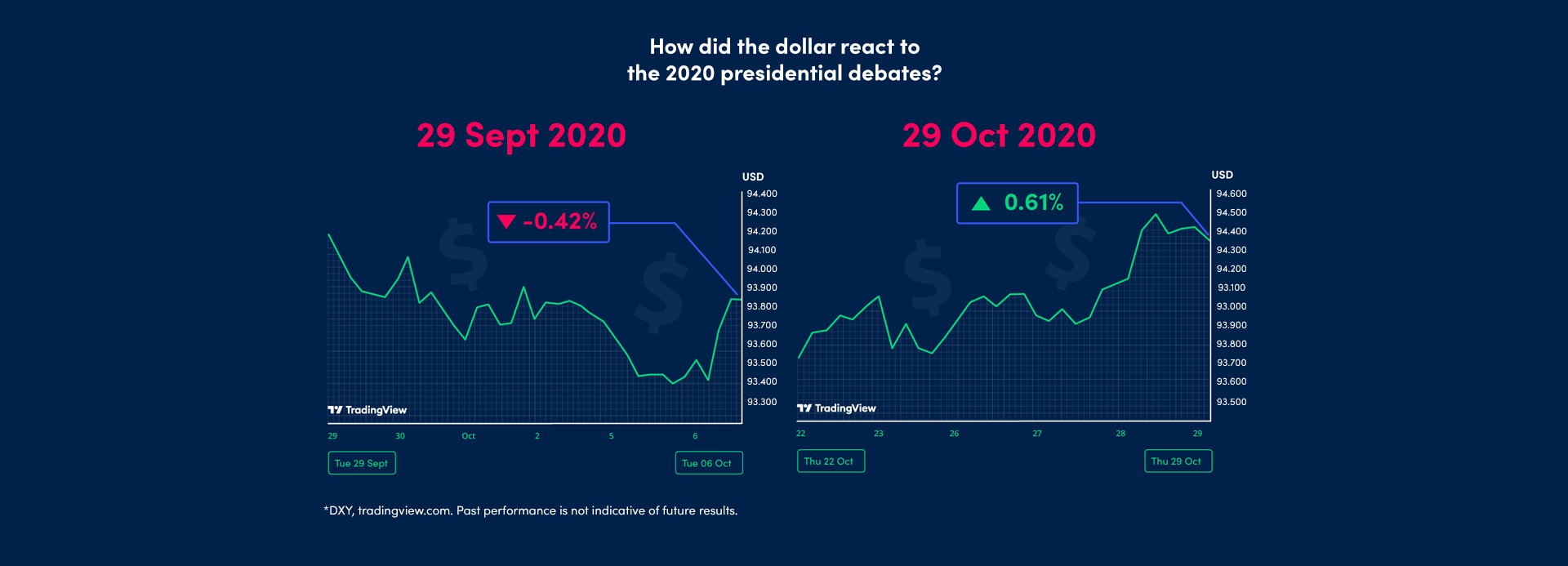

In the last presidential election, how did these major currencies perform?

Despite being the worst-performing currency as of March, the Australian dollar finished 2020 as the best-performing currency, up in value by 11.64%*

The dollar holds the title as the worst-performing currency of 2020, down -7.66% in value across the year*

Between Biden's official confirmation as victor and year end, the dollar continued to lose over 2.50% in value*

*tradingview.com. Past performance is not indicative of future results.

Client Sentiment

| Nome dello strumento | Ticker | % di investitori che vendono/acquistano | |

|---|---|---|---|

|

EURUSD

|

EURUSD | Controlla le condizioni » | |

|

DE30

|

DE30 | Controlla le condizioni » | |

|

GOLD

|

GOLD | Controlla le condizioni » | |

|

US100

|

US100 | Controlla le condizioni » | |

|

NATGAS

|

NATGAS | Controlla le condizioni » | |

|

BITCOIN (BTCUSD)

|

BTCUSD | Controlla le condizioni » | |

|

US500

|

US500 | Controlla le condizioni » | |

|

LITECOIN (LTCUSD)

|

LTCUSD | Controlla le condizioni » | |

|

OILWTI

|

OILWTI | Controlla le condizioni » | |

|

ETHEREUM (ETHUSD)

|

ETHUSD | Controlla le condizioni » | |

|

USDJPY

|

USDJPY | Controlla le condizioni » | |

|

PL20

|

PL20 | Controlla le condizioni » | |

|

USDPLN

|

USDPLN | Controlla le condizioni » | |

|

BITCOIN CASH (BCHUSD)

|

BCHUSD | Controlla le condizioni » |

| Nome dello strumento | Ticker | % di investitori che vendono/acquistano | |

|---|---|---|---|

|

PALLAD

|

PALLAD | Controlla le condizioni » | |

|

EURPLN

|

EURPLN | Controlla le condizioni » | |

|

EURTRY

|

EURTRY | Controlla le condizioni » | |

|

USDTRY

|

USDTRY | Controlla le condizioni » | |

|

USDHUF

|

USDHUF | Controlla le condizioni » | |

|

NATGAS

|

NATGAS | Controlla le condizioni » | |

|

FR40

|

FR40 | Controlla le condizioni » |

Live Markets

EURUSD

EURUSD.pro

--

(--)

GBPUSD.pro

--

(--)

USDJPY.pro

--

(--)

AUDUSD.pro

--

(--)

Track all markets on TradingView

Leveraged trading is high risk. Losses can exceed deposits.