To apply, you must be over 18 years old, and a legal resident of the United States. We only ask questions that are relevant to your application and for regulatory purposes. Be prepared to upload proof of identity and address, such as your driver’s license. If you pass eID, you won't have to provide further proof of identity and address documentation.

Individual accounts

We may need you to send some documentation to verify your identity. You can scan the below documents or use your smartphone to take a picture of the documents and submit them through our secure portal.

Driver’s license (proof of identity and address)

If you don’t have a driver’s license, you can also verify your identity and proof of address using the below documents:

Government-issued passport or ID card (proof of identity)

Utility bill, bank statement or other document with your name and address on it (proof of address)

Corporate accounts

To open a corporate account, you need to first apply online (step one), then submit a paper application, as well as supporting documents.

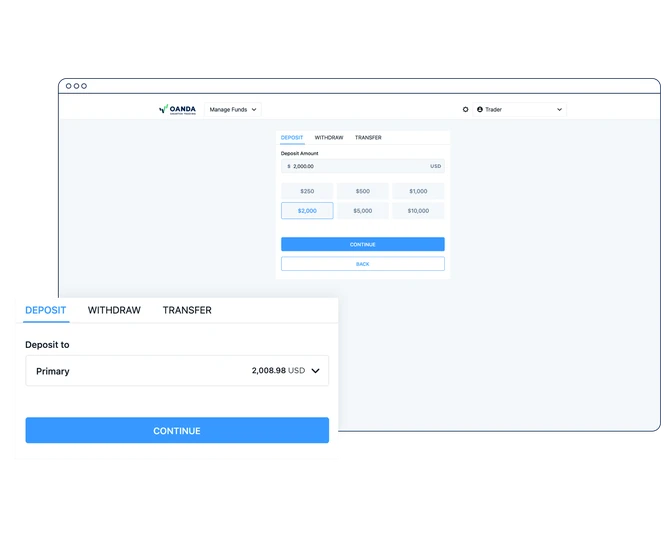

To deposit funds, log in to ‘manage funds’ using your OANDA account details and click on the ‘deposit’ button. You can fund your trading account using a number of methods, including debit cards, bank wire transfer and Automated Clearing House (ACH). There is no minimum deposit amount. Note: you can only deposit up to 50% of your net worth.

Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

With over 25 years of experience, OANDA offers leading tools, powerful platforms and transparent pricing.

Depositing and withdrawing funds

It is simple and straightforward to deposit and withdraw funds to and from your account.

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

Trade forex with OANDA

We are a globally- recognized broker with over 25 years' experience in foreign exchange trading.