Guaranteed stop-loss orders protect your positions by guaranteeing to exit your trades at the exact price you specify, regardless of market volatility. This is different from a stop-loss order which may be filled at a worse price level than the one you requested. GSLOs incur a fee (or GSLO premium), but this is only charged if the GSLO is triggered.

Market gapping occurs when prices move instantaneously from one price level to another, without trading at the levels in between. This can occur during periods of high market volatility and in between sessions of continuous trading. On weekends and public holidays when markets are closed for trading, for example.

As a result of this gapping, when the markets re-open your stop-loss orders may be filled at a worse price level than the one you may have requested. This is known as “slippage”.

GSLOs protect your trade against slippage or gapping

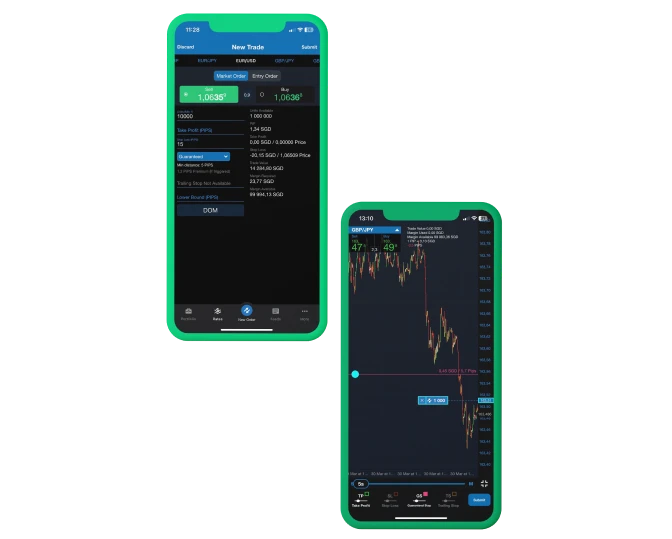

Placing a GSLO would protect your trade from this slippage. As seen in this chart, the market gapped but the GSLO was still filled at the requested price level. Since the GSLO was triggered, a GSLO premium was charged. If you had placed a stop loss-order, your trade would have been closed at the next available price when the markets re-opened for trading.

To add a GSLO to an order, simply tap the stop loss button and set your GSLO level either by price or select the level by the number of pips away from the entry price at which you would like your GSLO to be triggered. A GSLO must be placed a 'minimum distance' away from the entry price. This minimum distance is displayed on the ticket. The GSLO will be selected automatically here when adding a stop.

If a trade has a GSLO associated with it, this is displayed on the portfolio/trades screen like a normal stop loss, with an additional “G” next to the stop loss level.

Go from application to trading in three easy steps:

^Subject to meeting our criteria. Additional information/documentation may be requested prior to account activation to establish eligibility.

Let’s say you open one unit of a long CFD position on the UK 100 Index at 7000 and place your guaranteed stop 50 points away at 6950 as you are concerned about market volatility.

The premium being charged if the GSLO is triggered is 2 pips.

If the index gaps down 100 points to 6900, your position would automatically be closed out at your GSLO level of 6950 and you will realise a loss.

(order size x stop distance) + (order size x premium fee) = loss

(1 x 50) + (1 x 2) = GBP52.

If you hadn't placed the guaranteed stop on your position, but instead used a standard stop loss at 6950, your trade would have closed at 6900, resulting in a loss of GBP100.

With over 25 years experience, we offer multiple platforms and powerful tools to help you trade smarter.

Standard and professional accounts

Our accounts offer institution-grade execution, a relationship manager, 24-hour support and more.

Apply for an OANDA trading account

Open a live or practice trading account in three easy steps: apply, verify your identity and fund.

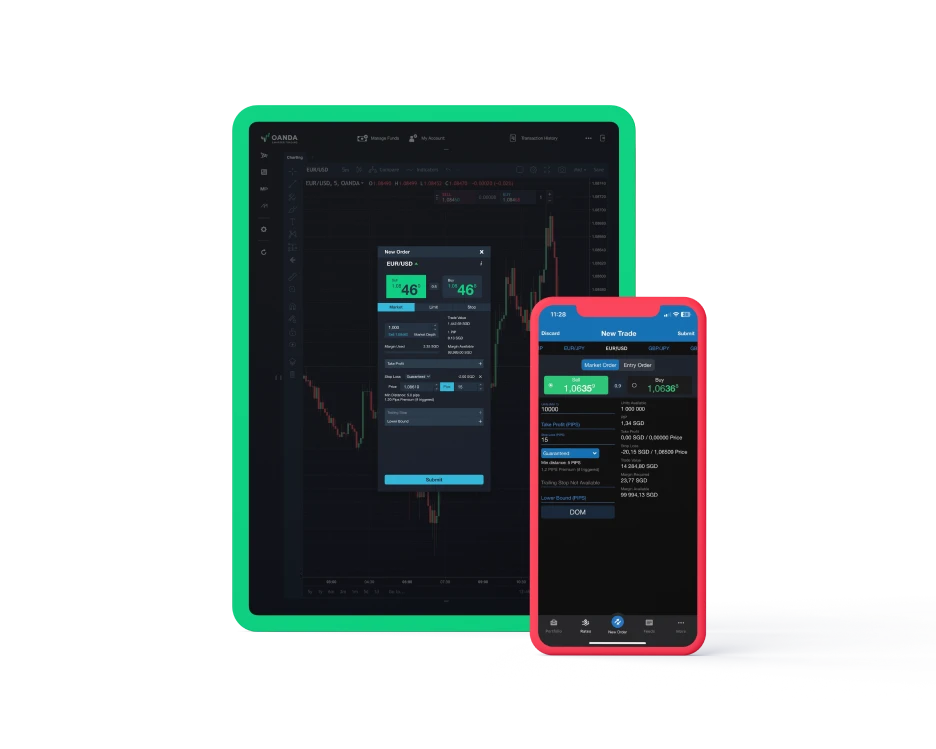

Take a position with our OANDA platform

Our OANDA platform can be accessed from your web-browser, tablet and mobile devices.