If you have an open position on your account at the end of each trading day (5pm ET), the position is considered to be held overnight and subject to either a financing charge or credit to reflect the cost of funding your position (in relation to the margin utilised).

The financing cost is calculated on a per position basis and may be a charge or a credit to your account, depending on whether you hold a buy/long position or a sell/short position. The financing charge or credit also takes into account the impact of our admin fee.

Daily financing charge or credit = size of position x applicable funding rate/365

Daily financing charge or credit = value of position* x applicable funding rate/365

*Where value of position = size of position x price at the end of trading day (5pm ET)

Funding rates (or ‘swap rates’ for FX products) vary depending on the instrument and may change on a daily basis. These are quoted as an annual rate. Each instrument has two quoted rates: one for a buy/long position and the other for a sell/short position.

A negative funding rate will result in a charge being debited from your account, and a positive funding rate results in a credit to your account.

The daily financing charge or credit will be claimed/passed from/to your account each day, and will be visible in your transaction history accessible via your account portal.

The below table shows how we calculate funding rates for our FX, metals and indices CFDs.

| Funding rates (long/buy positions) | Funding rates (short/sell positions) | |

|---|---|---|

|

FX, gold, and silver |

Rates are based on a blend of underlying liquidity providers’ tom-next SWAP rates, adjusted by the instrument-specific admin fee, and annualised.

|

Rates are based on a blend of underlying liquidity providers’ tom-next SWAP rates, adjusted by the instrument-specific admin fee, and annualised.

|

|

Indices |

Rates are admin fee of 2.5% plus relevant** alternative reference rate, annualised. Represented by a negative rate, and hence a charge.

|

When the relevant** alternative reference rate is greater than our 2.5% admin fee, the rate used will be the difference between the two, annualised. This is represented by a positive rate, and therefore a credit.

|

|

Share CFDs |

Rates are admin fee of 2.5% plus relevant** alternative reference rate, annualised. Represented by a negative rate, and hence a charge.

|

When the relevant** one month annualised funding rate is greater than our 3.0% admin fee⤉, the rate used will be the difference between the two, annualised. This is represented by a positive rate, and therefore a credit.

|

| Index | Reference rate |

|---|---|

| Australia 200 | AONIA |

| China A50 | SOFR |

| Germany 40 | ESTR |

| Europe 50 | ESTR |

| France 40 | ESTR |

| Hong Kong 33 | HKD DEPOSIT 1WK |

| Japan 225 | SOFR |

| US Nas 100 | SOFR |

| Netherlands 25 | ESTR |

| Singapore 30 | SORA |

| US SPX 500 | SOFR |

| Taiwan Index | SOFR |

| UK 100 | SONIA |

| US Russell 2000 | SOFR |

| US Wall St 30 | SOFR |

| Spain 35 | ESTR |

| Switzerland 20 | SARON |

| ChinaH Shares | HKD DEPOSIT 1WK |

| Japan 225 (JPY) | TONA |

| Share CFD | Alternative reference rate |

|---|---|

| EUR | ESTR |

| USD | SOFR |

| GBX | SONIA |

| SEK | SWESTR |

| DKK | DESTRA |

| Instrument | Admin fee |

|---|---|

| TRY pairs | 4.00% |

| CZK, HUF, SAR, THB, ZAR pairs | 2.00% |

| Other pairs | 1.00% |

Different asset classes settle on different days.

FX, gold, and silver trades typically settle on a T+2 basis, which effectively means that weekend financing is usually applied two days earlier on Wednesdays (tripling the usual daily rate), although this timeline is similarly impacted by public holidays.

Indices typically factor in weekend financing on a Friday (tripling the usual daily rate), although this timeline is also similarly impacted by public holidays.

Accordingly, the actual funding rate on any given day may reflect more than one day’s costs.

No financing charges or credits are applied to clients’ accounts over the weekend.

See our FAQs for examples of financing costs for CFD positions.

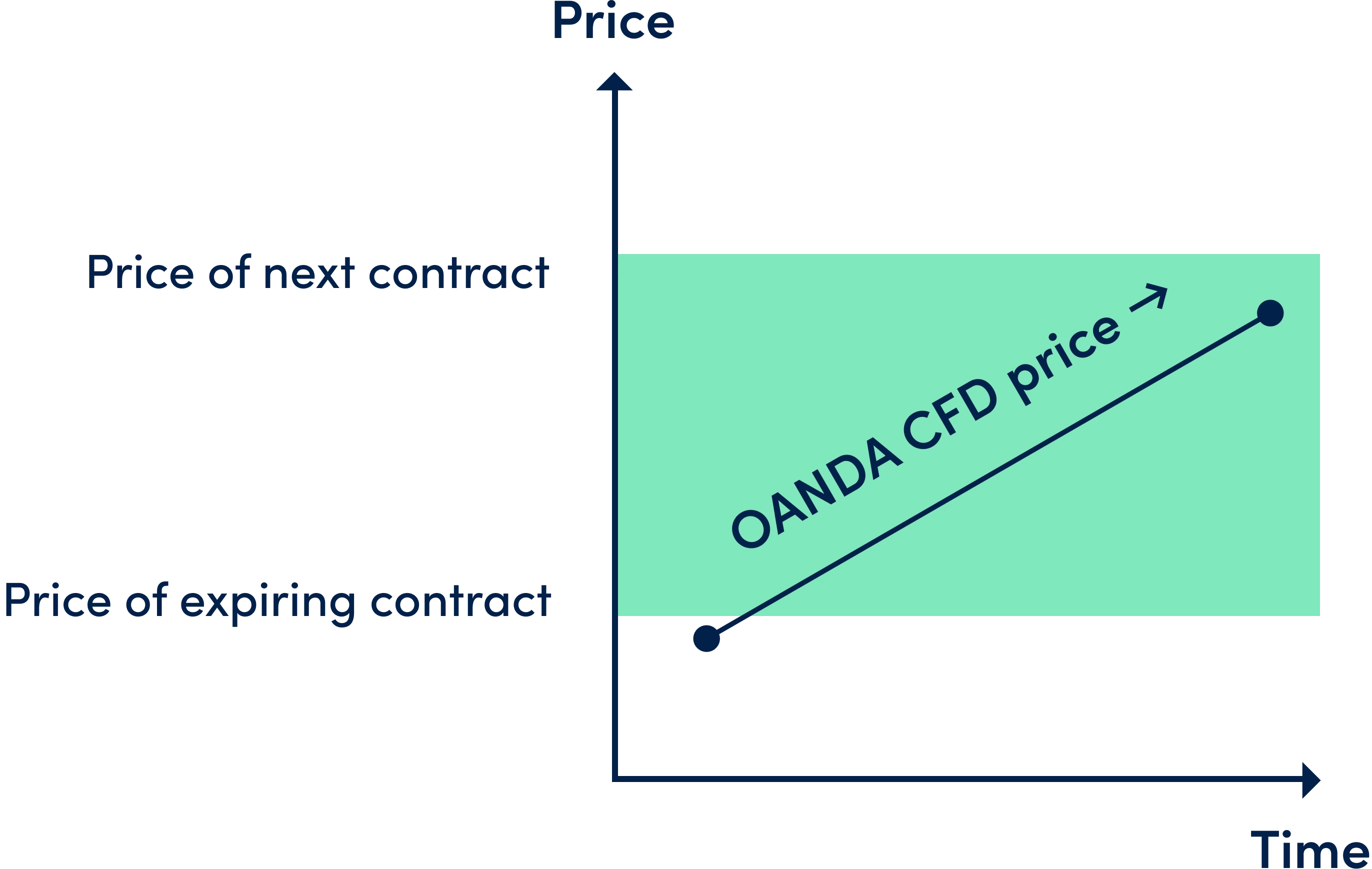

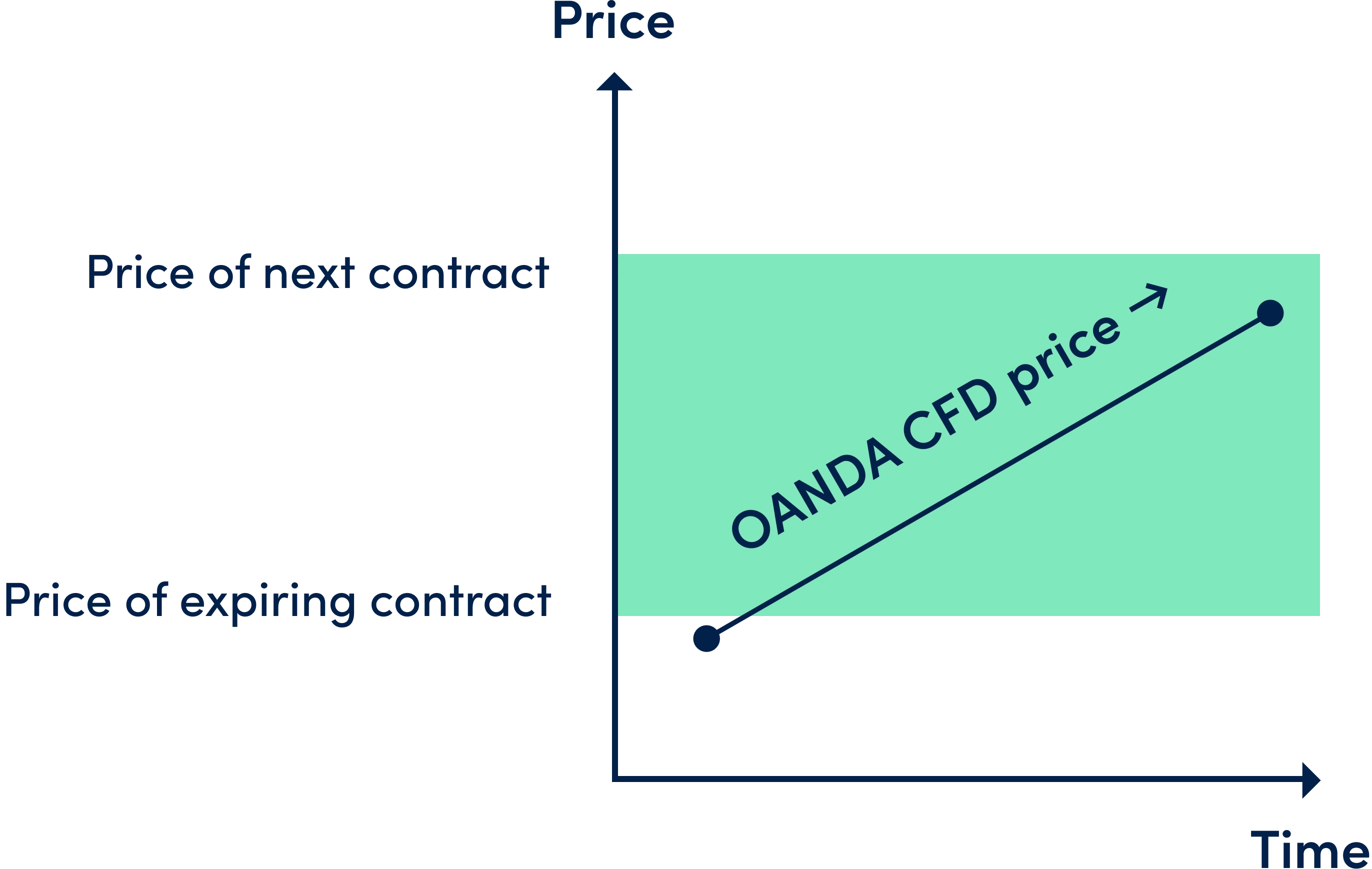

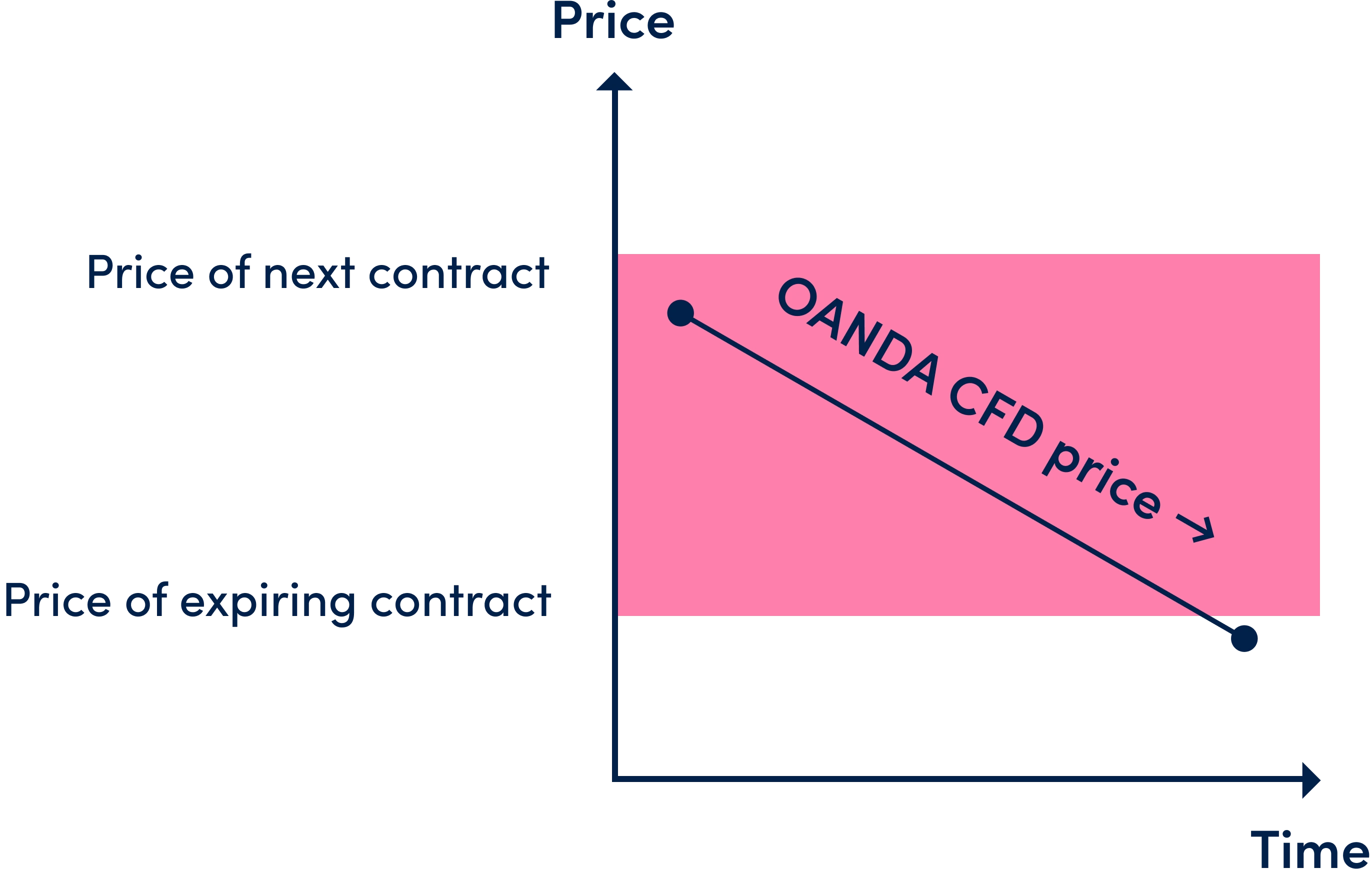

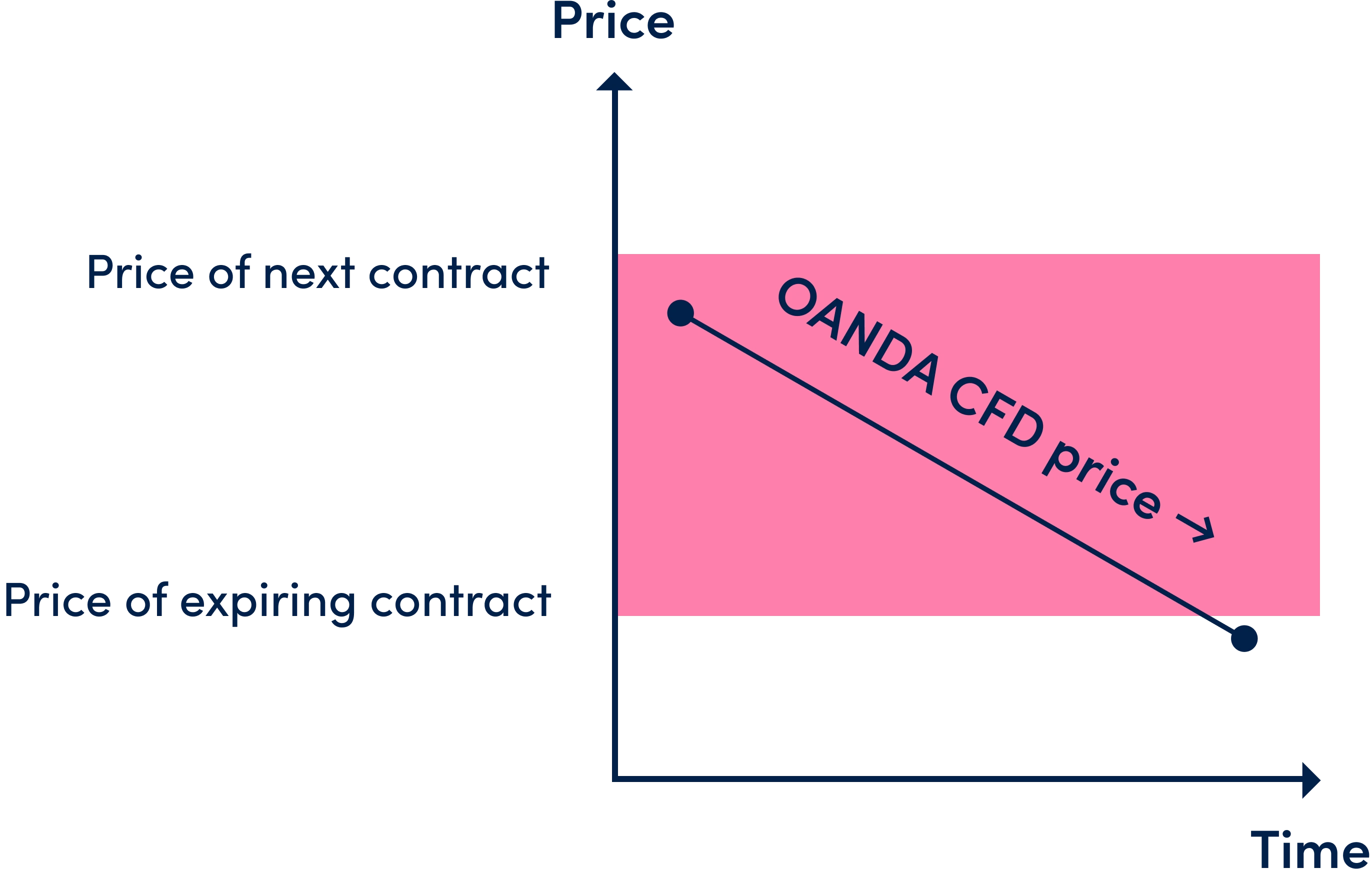

The prices of our commodity, metal (excluding gold and silver) and bond CFDs are based on underlying futures contracts. When an underlying futures contract is near expiry, we calculate the basis rate, which represents the difference in price between the expiring futures contract and the next futures contract. From that point forward, our CFD price is calculated as the present value of the price of the next futures contract, using the basis rate for the present value calculation. The present value is calculated continuously, second-by-second.

When the basis rate is positive, the CFD price will tend to move upwards towards the contract price. When the basis rate is negative, the CFD price will tend to move downwards towards the contract price.

(CFD price trading to move higher towards next contract price)

(CFD price trading to move lower towards next contract price)

Financing costs on commodity, metal (excluding gold and silver) and bond CFDs are therefore calculated on a continuous second-by-second basis.

For the duration of the trade the resultant financing charge/credit is debited/credited at the end of each day (5pm ET), and when the trade is closed.

Financing charge or credit = size of position x applicable funding rate x [trade duration (in days) / 365] x conversion rate to account currency

OANDA charges financing on commodity, metal (excluding gold and silver) and bond CFDs using the basis rate with a % admin fee applied. The basis rate portion of the financing amount is intended to offset the price movements caused by the present value calculation.

For long positions, your account will be debited the basis rate plus a 2.5% admin fee. For short positions, your account will be credited the basis rate minus a 2.5% admin fee (which could result in a charge where the basis rate is less than the admin fee).

Irrespective of the sub-account type, financing rates are calculated the same way. he way they are applied to sub-account types, however, does differ.

How the financing costs are applied to your account?

v20 accounts & v20 MT4 sub-accounts

Financing costs are credited/debited to accounts daily, i.e. the charges result in realised profit or loss.

This cash posting to the sub-account most usually happens on a daily basis as of the End of Day (EOD Time).

However, the cash posting may occur earlier for closed Positions on an underlying Instrument that is a commodity or bond, where the financing calculation is performed on a continuous, rather than daily basis.

OANDA One sub-account

Financing costs are generally booked as Swaps on each Deal for which they accrue, i.e. the charges result in ongoing unrealised profit or loss. (The cumulative Swaps accrued whilst a Position is open forms part of the realised profit or loss on the Position and is thereby credited/debited to the account when the Position is closed.

This accumulating update to the Deals happens on a daily basis as of the EOD Time.

However, for Positions on an underlying Instrument that is a commodity, Ffinancing costs are credited/debited to the account, i.e. the charges result in realised profit or loss.

Those postings to the account on the basis of the earlier of EOD time or the time at which a Position was closed intra-day.

You have a position of long 200,000 EURUSD on your account that has a base currency of GBP. This position is still open at the end of the trading day on a Tuesday, 5pm ET.

The long funding rate noted for EURUSD on this particular day is -2.68%; which means that you will pay financing for holding this position at 2.68% per annum.

Daily financing charge or credit = size of position x applicable funding rate/365

Charge = 200,000 x (-2.68% / 365) = - 14.68 EUR

You can always find the USD values of financing rates in the table at the bottom of this page.

As you are converting a negative EUR value to GBP (your account currency) you need to buy EURGBP, (the end of day price was 0.8573/0.8575) so the calculation is:

Daily financing charge or credit = size of position x applicable funding rate/365 x conversion rate

Charge = 200,000 x (-2.68% / 365) * 0.8575 = -12.59 GBP

You have a long position of 100 oz of XPDUSD (Palladium) on your USD account.

As outlined above, financing costs in this instrument are calculated on a continuous second-by-second financing basis.

You opened your position at 11:00:00 and closed it at 16:30:54

Firstly you need to know the number of seconds in which the position was open, 5hr, 30 mins , 54 seconds. This is 19,854 seconds

The number of seconds in a 365 day year is 31,536,000

The financing rate for Palladium is -4.40% annualised (basis rate plus admin fee). The price of XPDUSD when the position was closed was 1209.565/1213.557

If the interest rate is positive, then the bid price is used, if negative, then the ask price.

Financing charge or credit = size of position x applicable funding rate x [trade duration (in second) / seconds in a 365 day year] x conversion rate to account currency

The size of the position in USD is 100 * 1213.557 = USD 121,355.70

Therefore, funding charge = 121,355.70 * -4.40% * (19,854 / 31.536.000) = - $3.36

You have a short position of 50 indices of the US500 on your OANDA One account which has a base currency of GBP. The US500 has a long rate of -7.80% and a short rate of 2.80% per annum (alternative reference rate annualised and adjusted for admin fee). You will be receiving 2.80%.

Given you are receiving USD you would need to use the ask side of GBPUSD; which was trading at 1.23844/1.23853 at the close.

Daily financing charge or credit = size of position x applicable funding rate/365

Credit = ( 50 x 4460.90 ) x ( 2.80% / 365 ) / 1.23853 = 13.82 GBP

Rates and costs for today's date are approximate and will not be finalised until 5 pm ET.

The rates displayed for the current date are indicative, based on rates from liquidity providers and administrative fees. Our finalised rates for the current date are published shortly after the New York day close (5pm ET).

Indicative rates are published as a reference and guide, and may differ from the finalised rates applied to your positions. Any difference in finalised rates charged due to different account types are not reflected here.

*Long financing charge = the financing charge on a long position of the given instrument

^Short financing charge = the financing charge on a short position of the given instrument

(Financing charges are based on positions of 100,000 units for FX, 1 unit for Indices, 10 units for Gold, Silver, Palladium and Platinum, and 100 units for Commodities, Metals & Bonds)

Go from application to trading in three easy steps:

^Subject to meeting our criteria. Additional information/documentation may be requested prior to account activation to establish eligibility.

With over 25 years experience, we offer multiple platforms and powerful tools to help you trade smarter.

Our Charges

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

CFD trading

We offer CFD prices on a range of financial instruments, including indices, forex pairs, commodities, metals and bonds.

Hours of operation

Our operation hours coincide with the global financial markets. Find out when you can trade with us.