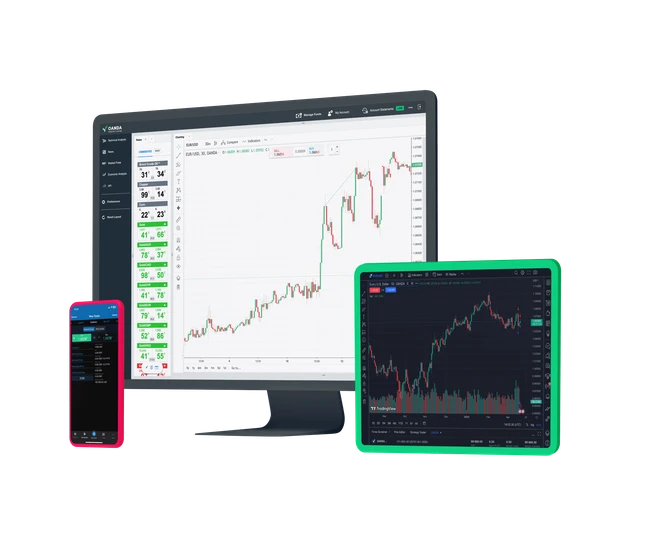

With OANDA, you can trade the big names using powerful tools and platforms.

Trade US, UK and EU share CFDs

Trade the big names in the US including Amazon, Nike, Netflix and Coca-Cola, as well as UK and EU listed shares. Our margins start from 5%.

Go long or short without ownership

Share CFDs give you the opportunity to profit from price movements without owning the underlying asset. Profit or loss are based on the price change between your trade entry and exit and not on the asset’s underlying value.

Trade directly from TradingView

You can log in and place trades directly from TradingView with your OANDA account. Simply create or log in to your TradingView account and choose OANDA as your preferred broker.

There are many benefits when you trade share CFDs with us:

The share CFD pricing in the table is delayed by 15 minutes.

OANDA allows clients to take positions up to a maximum position size on a per symbol basis. This maximum exposure is on a per client basis; and therefore applies to cumulative positions over all your trading accounts with OANDA.

This maximum position size is shown in your trading platform. In MT5 this is defined as 'Volume Limit' in the symbol specification or on our mobile platform it is noted as ‘Maximum Client Exposure’ in the Instrument Information section of the platform.

For further information see terms of business and FAQs.

We like to be totally transparent about our fees for all our products. The table below gives you an overview of commissions and other related costs. See our full list of charges and fees.

| Type of commission | Opening a position | Closing a position |

|---|---|---|

| For the execution of CFDs on Belgian shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Danish shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Finnish shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on French shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on German shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Dutch shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Portuguese shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Spanish shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on Swedish shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on US shares | 0.10% of position notional | 0.10% of position notional |

| For the execution of CFDs on UK Shares | 0.10% of position notional | 0.10% of position notional |

If you hold a long position on a share CFD, any dividend income you receive is subject to either a tax or a tax equivalent charge.

The rate of tax or tax equivalent that you pay is dependent on the country of domicile of the company whose share CFDs you have purchased. This country information can be found in the Instrument Specification on the MT5 platform in the Instrument Information section of the mobile application.

If you have purchased a share CFD of a United States domiciled company, then the tax you pay is determined by your country of tax residence and the tax treaty rate between your country and the US. If your country of tax residence does not have a tax treaty with the US, then the default rate as below is applied.

We’ve made every effort to ensure the accuracy of the below rates at the time of publication which are subject to change from time to time.

| Country | Tax rate |

|---|---|

| Austria | 27.50% |

| Australia | 30.00% |

| Belgium | 30.00% |

| Bermuda | 0.00% |

| Canada | 25.00% |

| Switzerland | 35.00% |

| Cyprus | 0.00% |

| Germany | 26.375% |

| Denmark | 27.00% |

| Spain | 19.00% |

| Finland | 35.00% |

| France | 25.00% |

| Great Britain | 0.00% |

| Guernsey | 0.00% |

| Ireland | 25.00% |

| Israel | 25.00% |

| Isle of Man | 0.00% |

| Jersey | 0.00% |

| Japan | 15.315% |

| Cayman Islands | 0.00% |

| Luxembourg | 15.00% |

| Netherlands | 15.00% |

| Panama | 0.00% |

| Poland | 19.00% |

| Puerto Rico | 10.00% |

| Portugal | 25.00% |

| Sweden | 30.00% |

| Singapore | 0.00% |

| Taiwan | 21.00% |

| United States | 30.00% |

| British Virgin Islands | 0.00% |

Most of the share CFDs that we offer are available for full trading. For market reasons, some products may only be available to go ‘long only’, ‘close only’, or some might be disabled for trading. Any share CFDs not available for full trading are listed below.

Put simply, share CFDs allow you to trade with leverage, whereas the trading of physical shares requires payment of the full cost of those shares. By trading share CFDs, you are speculating on the price of the underlying asset, you are not taking ownership of it. The leverage you get with share CFDs will amplify both profits and losses. With physical shares you can only lose the amount you spent to acquire them. This is why buying physical shares is more of a long-term strategy, where you are looking to cash in years down the line, not in a week or two, as would be typical of trading share CFDs.

If you’re just starting out as a trader in your spare time, it pays to study and practice trading share CFDs on a demo account before jumping in feet first. As with any asset, there are many ways to trade share CFDs. Some will opt to trade over a few minutes while others prefer to hold positions for a number of weeks. A lot depends on how much time you want to invest in trading and analysing your charts.

If you’re still exploring different ways of trading share CFDs, check out our Learn pages where you’ll find plenty of resources to help get you started with topics such as fundamental analysis, technical analysis and how to use popular indicators.

You can trade share CFDs on the MetaTrader 5 platform and our mobile app.

Once you have downloaded and installed our user-friendly mobile app, you can log into your account(s) using a single login. From there you can trade share CFDs. If you have more than one MT5 account, you can switch from one account to the next without having to log out and log in again.

Corporate actions are events such as dividends and bonus issues of shares carried out by a publicly traded company that impact its shareholders and, similarly, the price of share CFDs.

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

With over 25 years of experience, the OANDA Group offers leading tools, powerful platforms and transparent pricing.

Trade indices CFDs

Take a position on major global indices, including Germany 30 and UK 100 with competitive spreads.

Trade popular cryptocurrencies

Trade Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dogecoin and more with competitive spreads from your OANDA account.

Three ways to trade

Choose from a range of leading platforms, including TradingView, MetaTrader and our mobile app for iOS and Android.