Take advantage of competitive spreads.

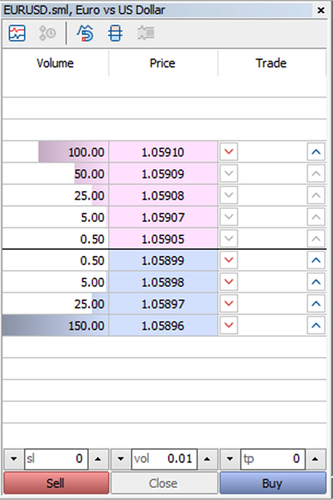

Simply right click on a symbol in ‘market watch’ and choose 'Depth of Market’.

Requested number of lots

If the requested number of lots is greater than the equivalent volume available on the first level of depth, the system will look down the depth of market to calculate the entry/closing price. After entering a number of lots greater than those available on level 1, the market depth is highlighted according to the number of lots entered.

List of prices

This will show a list of prices and the number of units available at each price. If you enter an order where the number of units is greater than the number of units available on the first level (we will execute the maximum number of units available at the first level), the next portion of the order’s units over the first level price will be calculated from the subsequent price level.

Multiple levels

This could include multiple levels, depending on the size of the order. The range of levels being used will be highlighted by the order ticket.

If the next level’s number of units is still not sufficient to fill the entire order, the process will repeat, filing down the depth of market until the entirety of the order’s number of units has been filled. If the order being submitted is larger than the total number of units available across all the price levels, the order will be rejected.

How it works

For example, if there is a first level with 1,000 available units and an order for 1,100 units is submitted, the first 1,000 units of the order will use the first level price, while the remaining 100 units of the order will use the second level price.

Orders filling at depth

This means that the price of an order filling at depth will be calculated as a ‘Volume Weighted Average Price’ (or VWAP), using prices from the depth of market. Each level being used in the calculation will contribute to the order’s price, weighted by the number of units being filled at each level.

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Yes, depth of market can be applied to all available order types. This includes entry (market, limit and stop) and exit (stop-loss, trailing stop-loss and take-profit) orders.

The depth of market functionality applies to all asset classes, but the levels of depth will vary across instruments – some may only have one level. You can view the current market depth for an instrument by opening the order ticket and clicking on the Market Depth/DOM window.

We offer the ability to view the ‘Depth of Market’ to give you an understanding of the underlying liquidity for your trading size.

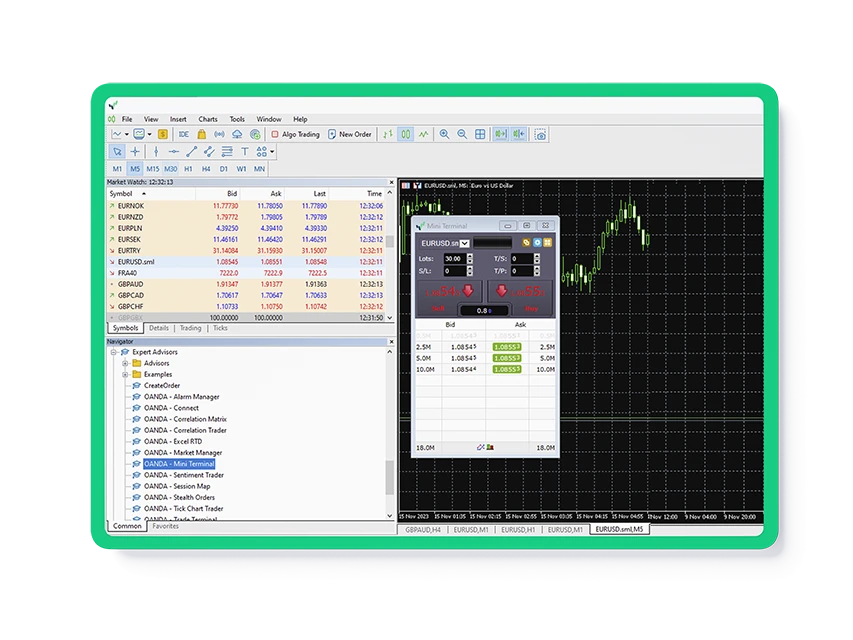

You can see the liquidity laid out in bands natively in the MT5 platform.

The level of liquidity that satisfies your total trade volume is the band used to execute your trade.

MT5

In the below example, if you want to buy 30 lots (3 million) EURUSD in MT5, then you would be filled for the total volume of your order at 1.05909. This is the volume available that satisfies the entirety of your order.

You can access Depth of Market from the View menu. The Depth of Market window shows the liquidity available for the relevant instrument.

If multiple orders are triggered at once when the combination of the orders would require executing at depth, the orders are executed on the same basis as if they were combined as one order. So the first order would consume a portion of the depth of market, the second order would carry on from where the first order concluded and so on for each of the orders.

With over 25 years of experience, the OANDA Group offers leading tools, powerful platforms and transparent pricing.

Depositing and withdrawing funds

It is simple and straightforward to deposit and withdraw funds to and from your OANDA account.

Trade forex CFDs

Trade CFDs on major and minor forex pairs with competitive spreads. Take a position using the MetaTrader 5 platform.

AutoChartist technical analysis

Scan the intraday markets using automatic chart pattern recognition and pattern quality indicators.